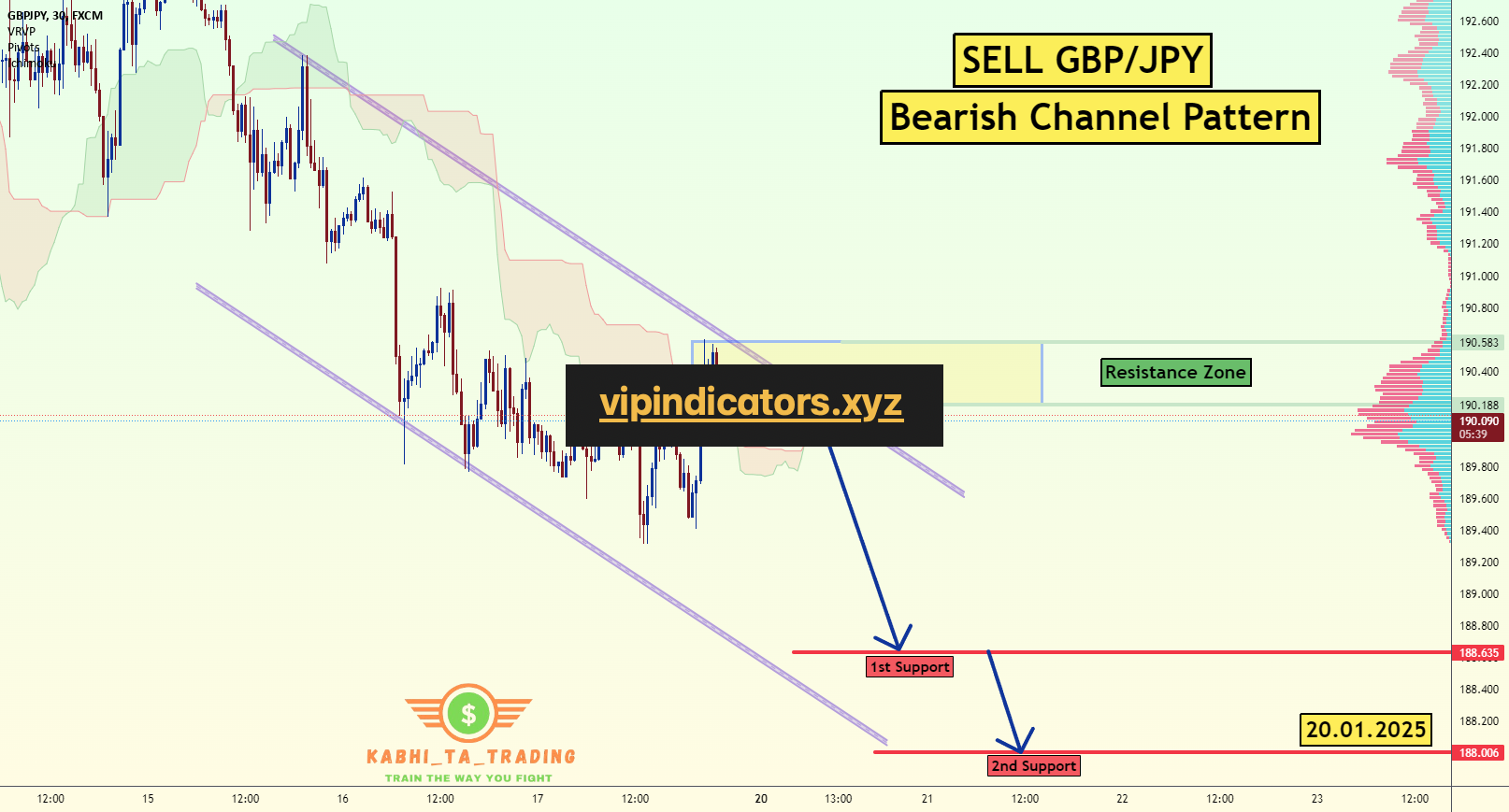

Currently we are still in the bearish market and price have recently touched and reacted to 4hr fvg. right now price failed to make a HH and formed LH instead so I am looking for short right here. SL is put above the LH formed so if market reverses it will prevent account from further loss.

Entry-190.1-190.2

SL- 190.5

Tp1-189.5(strong support)

Tp2-188.9

Tp3-188.6

Blog

-

British Pound / Japanese Yen

-

British Pound / Japanese Yen

The GBP/JPY Pair on the M30 timeframe presents a Potential Selling Opportunity due to a recent Formation of a Channel Pattern. This suggests a shift in momentum towards the downside in the coming hours.

GBPJPY

Possible Short Trade:

Entry: Consider Entering A Short Position around Trendline Of The Pattern.

Target Levels:

1st Support – 188.64

2nd Support – 188.00

🎁 Please hit the like button and

🎁 Leave a comment to support for My Post !

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, KABHI_TA_TRADING

Thank you. -

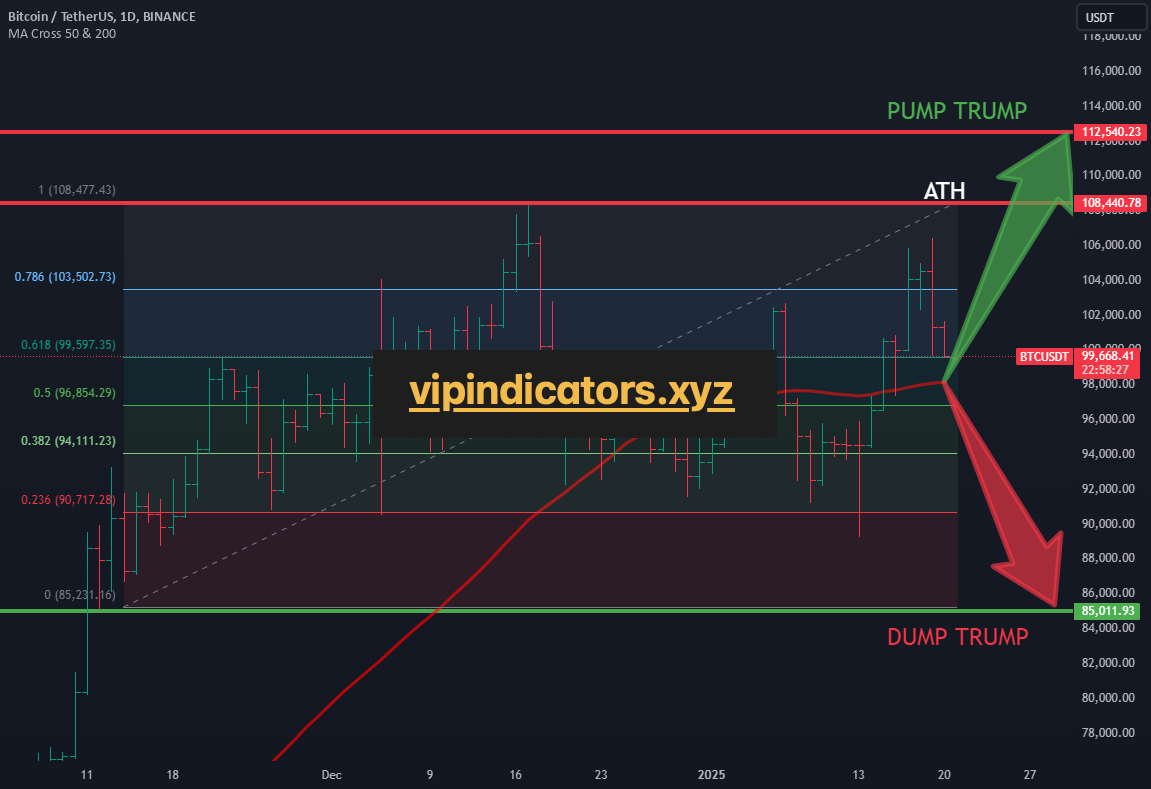

Bitcoin / TetherUS PERPETUAL CONTRACT

Greetings, this is the immediate bullish Elliott Wave Count for BTC. I also did a 4H count which takes a deeper retracement into consideration which will be linked below in the notes. I’ll like it below in the notes for everybody that is interested it in 🙂 Spoiler: This Analysis gets a bit more complex.

In the immediate bullish count we assume that Bitcoin is forming a double 1-2 set up which should lead to a rather aggressive Wave 3 to the upside. From the low which formed the blue Wave 4 we have a five wave move up displayed in purple which finished white Wave 1. We also formed white Wave 2 already which is a very shallow Wave 2 but it hit the minimum requirements of the 0.236 FIB at 98031.9 USD which is very rare and not preferred but valid.

From here we have started white Wave 3 of which we finished the first Wave displayed as the green Wave 1 here and we are currently working on the green Wave 2 in the yellow ABC.

Green Wave 2 support sits between the 0.5 FIB at 101538.8 USD and the 0.786 FIB at 99110.5 USD.

Yellow Wave A seems to be in as well as yellow Wave B which could extend tho.

Assuming yellow Wave B is in we can calculate targets for yellow Wave C which are very well in confluence with our green Wave 2 support.

Targets for yellow Wave C are the 1 to 1 FIB at 101420.9 USD, the 1.236 FIB at 100585.2 USD, the 1.382 FIB at 100068.2 USD and the 1.618 FIB at 99232.4 USD.

Noteworthy is that all targets for yellow Wave C overlap with the Fibonacci’s of green Wave 2 support area.

Additionally the 1.618 FIB target at 99232.4 USD of yellow Wave C which overlaps with the 0.786 FIB of the green Wave 2 support area at 99110.5 USD also overlap with the 0.382 FIB at 99337.8 USD of our Wave 2 support area of the “BTC – 4H Elliott Wave Analysis” which focusses on a deeper retracement which I’ll link below in the notes. The golden pocket of green Wave 2 also sits perfectly on 100’000 USD which is an important psychological level.

The green & white Wave 3 should take us well above the last ATH at 108366.8 USD.

On the chart you can see some targets for white Wave 3 which are the 1 to 1 FIB at 109234.6 USD, the 1.236 FIB at 112.052.7 USD, the 1.382 FIB at 113796.1 USD and the 1.618 FIB at 116614.1 USD.

Noteworthy is that the 1 to 1 FIB target at 109234.6 USD is right above the ATH at 108366.8 USD which could function as a short term resistance, so be aware of volatility!

Additionally we got some confluence for the 1.618 FIB target at 116614.1 USD with a high timeframe target at 115948.9 USD which I discussed in my “BTC – 1D Elliott Wave Analysis” which I’ll link below in the comments.

Be aware that we get the inauguration of Trump next week and the stock market is closed on Monday which both can have some effect on Crypto.

If you enjoyed this analysis I’d appreciate if you give it a boost as I put a lot of effort into it 🙂

Thanks for reading.

NO FINANCIAL ADVICE. -

U.S. Dollar / Canadian Dollar

🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the USD/CAD “The Loonie” Forex market. Please adhere to the strategy I’ve outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 👀 Be wealthy and safe trade.💪🏆🎉

Entry 📈 : You can enter a Bull trade at anypoint,

however I advise placing Buy limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑: Using the 2h period, the recent / nearest low or high level.

Goal 🎯: 1.44850 (or) Escape before the target

Scalpers, take note : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

Warning⚠️ : Our heist strategy is incompatible with Fundamental Analysis news 📰 🗞️. We’ll wreck our plan by smashing the Stop Loss 🚫🚏. Avoid entering the market right after the news release.

Fundamental Outlook 📰🗞️

The USD/CAD pair is expected to move in a bullish trend, driven by several fundamental factors:

US Economy: The US economy is expected to grow, driven by a strong labor market and increasing consumer spending.

Canadian Economy: The Canadian economy is expected to slow down, driven by a decline in crude oil prices and a decrease in housing market activity.

Interest Rate Divergence: The Federal Reserve (Fed) is expected to keep interest rates steady, while the Bank of Canada (BOC) is expected to cut interest rates, which could lead to a widening of the interest rate differential between the two currencies.

Commodity Prices: Canada is a major commodity exporter, and a decline in commodity prices could hurt the Canadian economy and support the USD.

UPCOMING NEWS:

US Retail Sales: The US retail sales for July are expected to increase by 0.3% monthly, which could lead to a strengthening of the USD.

Canadian Retail Sales: The Canadian retail sales for July are expected to decrease by 0.2% monthly, which could lead to a weakening of the CAD.

US Consumer Price Index (CPI): The US CPI for July is expected to increase by 0.2% monthly, which could lead to a strengthening of the USD.

Canadian CPI: The Canadian CPI for July is expected to decrease by 0.1% monthly, which could lead to a weakening of the CAD.

Please note that this is a general analysis and not personalized investment advice. It’s essential to consider your own risk tolerance and market analysis before making any investment decisions.

Take advantage of the target and get away 🎯 Swing Traders Please reserve the half amount of money and watch for the next dynamic level or order block breakout. Once it is resolved, we can go on to the next new target in our heist plan.

Keep in mind that these factors can change rapidly, and it’s essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I’ll see you soon with another heist plan, so stay tuned 🫂