Blog

-

Gold Spot / U.S. Dollar

Broken Channel:

The price recently broke out of a rising channel, signaling a potential shift in trend. Following the breakout, it retested the broken channel boundary, indicating that this level now acts as resistance.

Double Top Formation:

A double-top pattern can be observed near the upper resistance zone around $2,710–$2,730, suggesting that the price struggled to maintain upward momentum. This is a bearish signal, implying a potential reversal in the near term.

Middle Line of the Larger Channel:

The price touched the middle line of the larger upward channel before retracing, highlighting the importance of this level as a key resistance zone.

Potential Path:

if the price fails to break above the resistance zone ($2,710–$2,730), it could decline sharply toward the next support levels around $2,580 and $2,540. -

CFDs on WTI Crude Oil

WTI Crude Oil is neutralizing the previously overbought 1D technical outlook (RSI = 69.520, MACD = 2.080, ADX = 64.888) as after crossing over the R1 level, it is pulling back under it. Technically this has been mirroring the March-August 2023 fractal and based on that, we should see this pull back almost reach the 1D MA50. A buy opportunity is waiting there and our target is the 1.618 Fibonacci level (TP = 86.00).

-

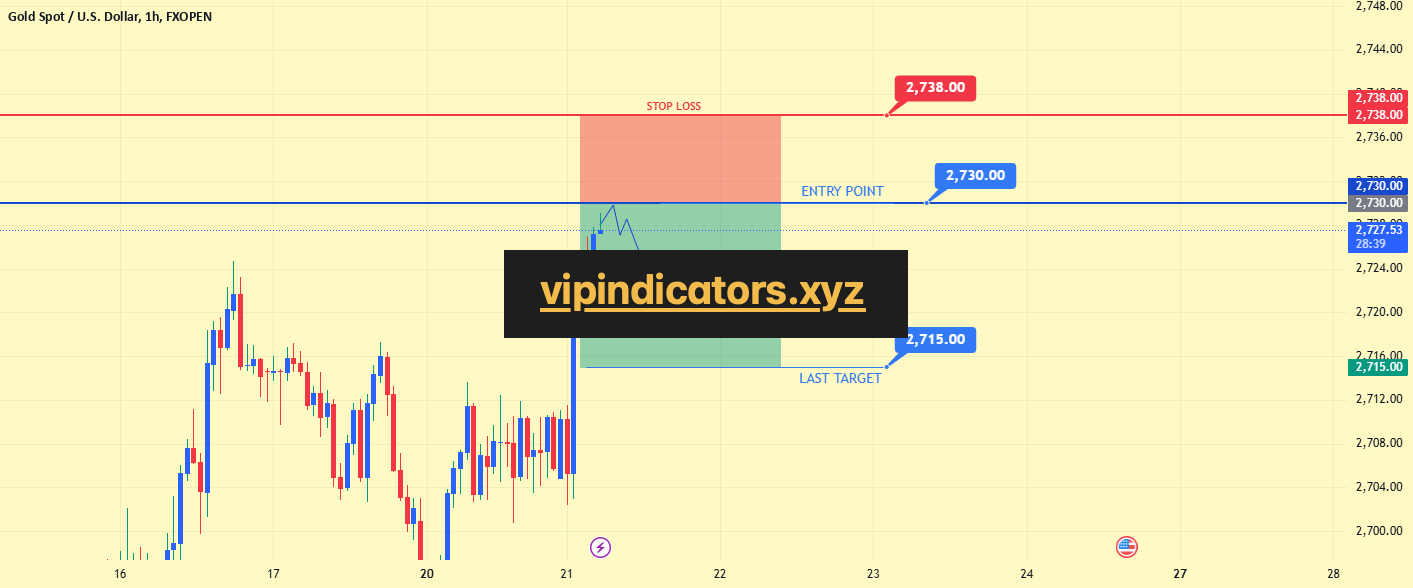

Gold Spot / U.S. Dollar

Baddy dears friends

Gold trading signals technical analysis satup

I think now gold ready for sell trade gold sell zone enter point 2727 to 2730

First tp 2722

2nd tp 2718

last target 2715

stop loss 2738

Tachincal analysis satup

Fallow risk management