Bitcoin has settled in the range of $99,000–$95,000, showing signs of weakening bullish momentum. Diminishing trading volumes and macroeconomic pressure suggest the market may be preparing for a downward move.

🔥 FinCaesar’s Key Insights and Strategy:

1. Market Analysis:

Downside Probability: High. A break below $95,000 could lead to a rapid decline to $87,000 or even $75,000.

Upside Potential: A breakout above $102,000 might reignite bullish momentum, but current market conditions favor a correction.

2. Action Plan:

Sell: If price drops below $95,000, secure profits and prepare for a further decline.

Wait to Buy: Avoid buying now. Look for accumulation opportunities near $92,000 or a clear breakout above $102,000 for safe re-entry.

3. Recommendation:

At this moment, selling and waiting for clearer signals or lower levels is the optimal strategy.

“The market rewards patience. Make the right move before it’s too late.” — FinCaesar

#FinCaesar #Bitcoin #CryptoStrategy #BTCForecast #CryptoAnalysis #Blockchain #FinancialFreedom

Blog

-

BTC Analysis: Current Market Insights

-

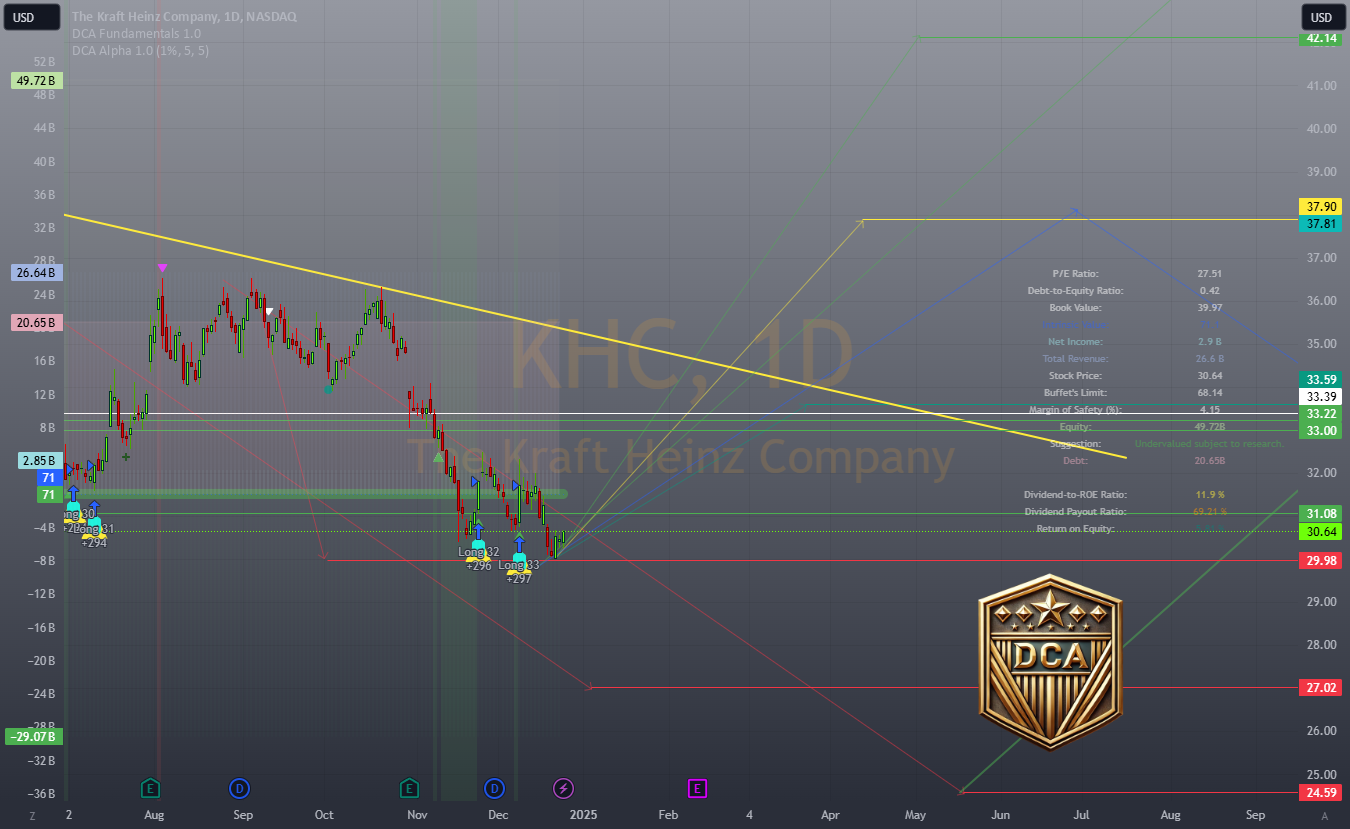

Kraft Heinz $KHC: Dividends, Value, and a Dash of ESG Ambition

Introduction:

Kraft Heinz (KHC) offers a tempting mix of a 4.9% dividend yield, undervaluation metrics, and brand strength. At $30.64, near the bottom of its 52-week range, KHC could be a solid addition to a long-term portfolio. But there’s more—this consumer staples giant is also ramping up its ESG initiatives, showing that even legacy brands can innovate. Let’s unpack the numbers and see if KHC is the value play you’ve been looking for. 📈

Key Points

1. Financial Snapshot 💵

Stock Price: $30.64

52-Week Range: $30.40 – $38.96

Market Cap: $43.71 billion

Dividend Yield: 4.9%

“KHC’s dividend yield is one of the most attractive in the sector, providing consistent income for investors in uncertain markets.”

2. Valuation Metrics 📊

P/E Ratio: 14.8x (below sector averages).

Price-to-Book Ratio: 0.79 (trading below book value).

“With metrics like these, KHC offers a value opportunity for those willing to ride out the turnaround.”

3. ESG Performance 🌱

Kraft Heinz is stepping up in sustainability:

Environmental: Initiatives to reduce carbon emissions and improve water efficiency.

Social: Diversity, equity, and inclusion targets by 2025.

Governance: Transparent reporting and linking executive pay to ESG goals.

“KHC isn’t just about profits—it’s working to align with the growing demand for sustainable and ethical practices.”

4. Buffett’s Endorsement 🛡️

“Berkshire Hathaway still owns a significant stake in Kraft Heinz. While Buffett admits to overpaying, his continued investment signals confidence in the brand strength and dividend reliability.”

5. Investment Strategy 💡

DCA Opportunity: At $30.64, near its 52-week low, KHC is a strong candidate for Dollar Cost Averaging.

Long-Term Potential: With steady dividends and brand strength, KHC is positioned as a reliable income and growth play.

Conclusion:

Kraft Heinz offers value, income, and a growing focus on sustainability. For investors seeking a balance of dividend reliability and long-term growth, KHC could be a worthy addition to your portfolio. 🌟

Disclaimer:

This analysis is for informational purposes only and does not constitute financial advice. Always conduct your own research or consult a financial advisor before making investment decisions. -

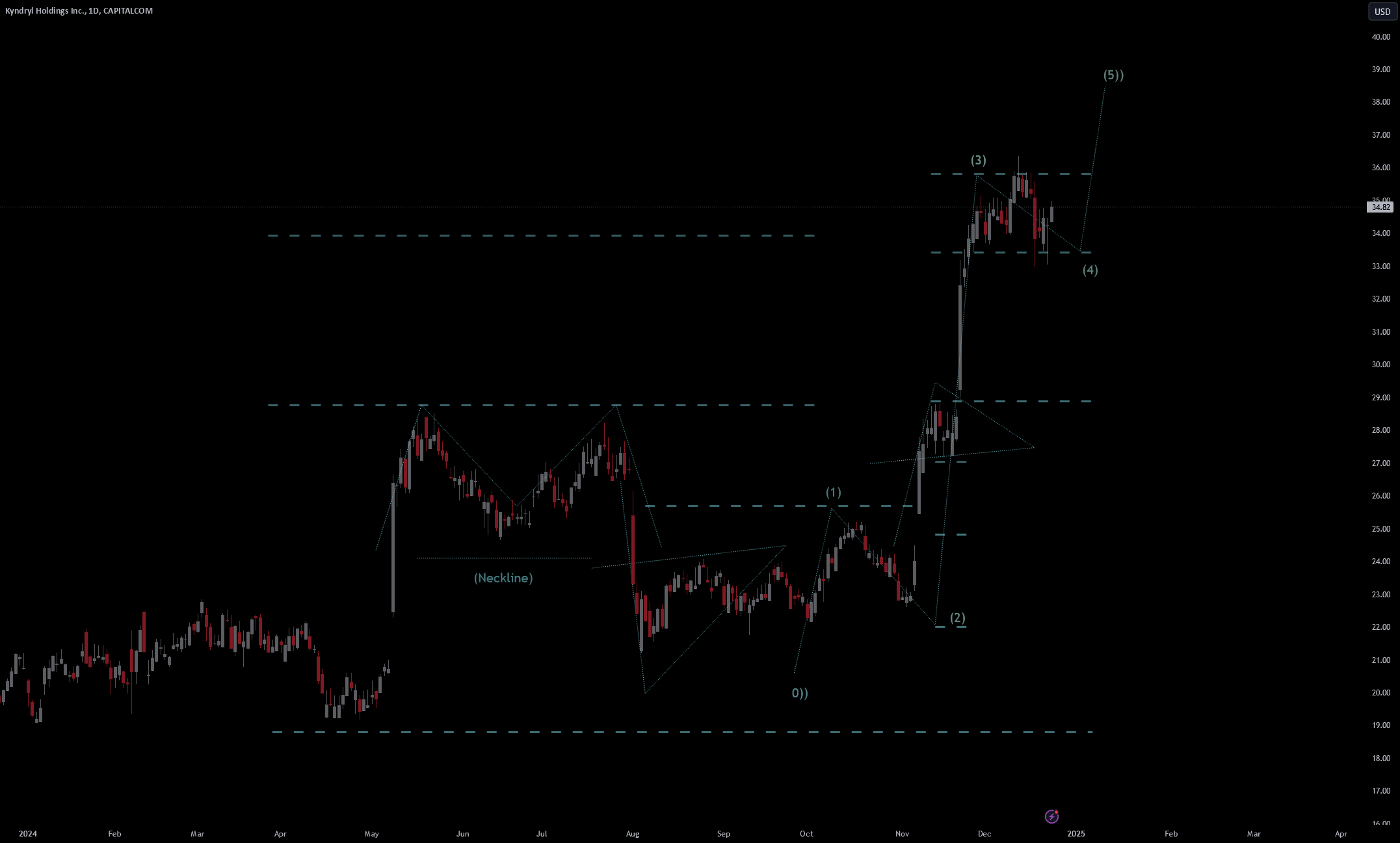

Kyndryl Holdings Inc. | Chart & Forecast Summary

Key Indicators On Trade Set Up In General

1. Push Set Up

2. Range Set up

3. Break & Retest Set Up

Notes On Session

# Kyndryl Holdings Inc.

– Double Formation

* (Neckline) | Completed Survey On Pattern

* Retracement Not Numbered | Subdivision 1

– Triple Formation

* 012345 | Wave Count Condition | Subdivision 2

* Pennant Structure | Uptrend Bias At 27.50 USD

* Daily Time Frame | Trend Settings | Subdivision 3

Active Sessions On Relevant Range & Elemented Probabilities;

European Session(Upwards) – US-Session(Downwards) – Asian Session(Ranging)

Conclusion | Trade Plan Execution & Risk Management On Demand;

Overall Consensus | Buy -

PHA / Bitcoin

Technical vision of an expected movement of this stock

Great Ascending Cycle Provided 291 Satoshi Break Target 945 -

Bitcoin / TetherUS PERPETUAL CONTRACT

We can see on Monday 23rd 2024 during nyse hours, after a bitcoin drop, BTC was ranging between 92.6 and 96k.

We can also see that during this range TOTAL3 (alts) broke range structure decisively to the upside signaling a bottom with a bullish increase of 3.25% within an hour (something that a day later would propel bitcoin to break its range up to 99k so far).

The TOTAL3 rise was also precipitated by a BTC.D -2% perpendicular drop within a timespan of 9 hours, that would later culminate in TOTAL3 rise exactly around BTC.D Pivot.

*Note that BTC drops in price usually go hand in hand with a rise of BTC.D not a drop of BTC.D, adding to the number of anomalies that were present in the Price Action at the time.

We can thus use TOTAL3 to assist us in bias confirmations as it measures investors overall confidence in the ecosystem onto our toolbox indicators.

We can thus also use BTC.D drops in timing TOTAL3 rises.

As in all in trading everything is fallible prone, and should be used with corresponding precautions. -

Euro / U.S. Dollar

Price declined a little from the resistance level of 1.04390 if we’d see buyers bounce back to that price level. Buyers may ride the price to a level of 1.05233

-

XVG for the meme

its one of few ISO20022 compliant coins.

hasn’t really moved all that much compared to the others out there.

actual target is 3.2ish cents

best case scenario (realistically) – 7.6ish cents