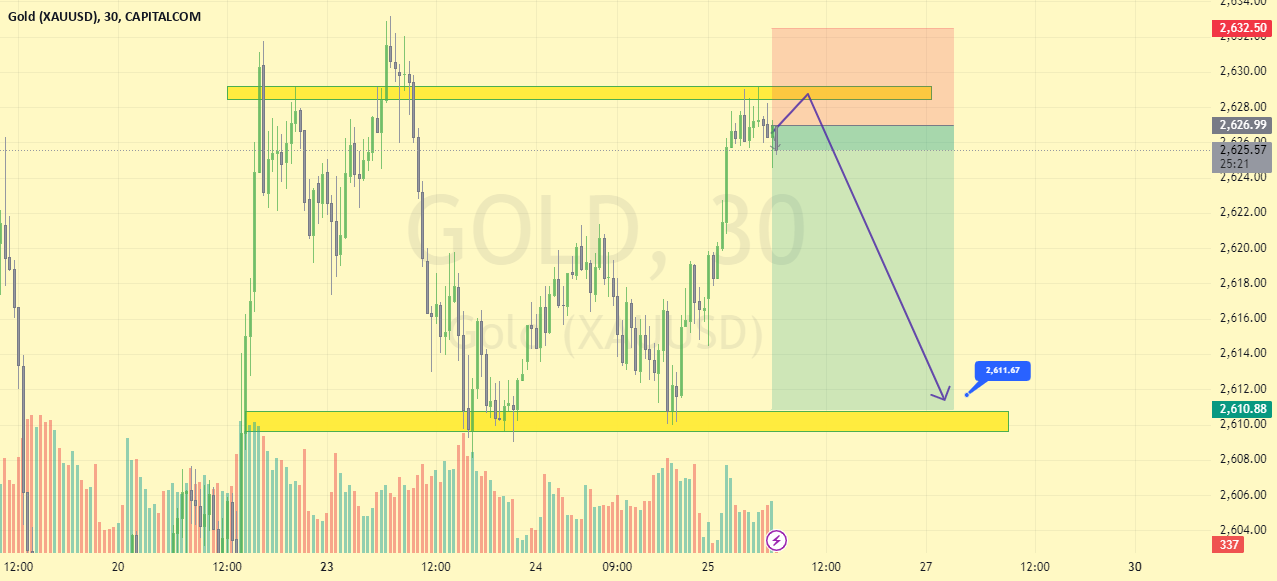

HELLO TRADERS WHAT ABOUT THINK GOLD? MY ANALYISIS GOLD TARGET 2611 SO BI ALERT AND SEE MY TARGET STOPLOSS SET TRADE 2635 Here’s a summary of your updated XAU/USD trade plan:

Trade Plan

– Entry Point: 2628 (current)

– Target: 2611

– Stop-Loss: 2635

Market Analysis

The XAU/USD is experiencing a minor correction, driven by a short-term strengthening of the US dollar.

Technical Analysis

– RSI Indicator: The Relative Strength Index (RSI) is below 50, indicating a short-term bearish momentum.

– Moving Averages: The 50-day moving average is trending downwards, supporting the bearish view.

– Resistance Levels: The resistance levels at 2635 and 2640 could provide a selling opportunity in case of a bounce.

Risk Management

– Risk-Reward Ratio: Your risk-reward ratio is approximately 1:1.7, which is relatively conservative.

– Position Sizing: Make sure to adjust your position size according to your risk tolerance and account size.

FOLLOW MY CHART AND GIVE ME LIKE AND COMMENT IM RIGHT THANKS GUYS

Blog

-

xauusd market 2611 target possible

-

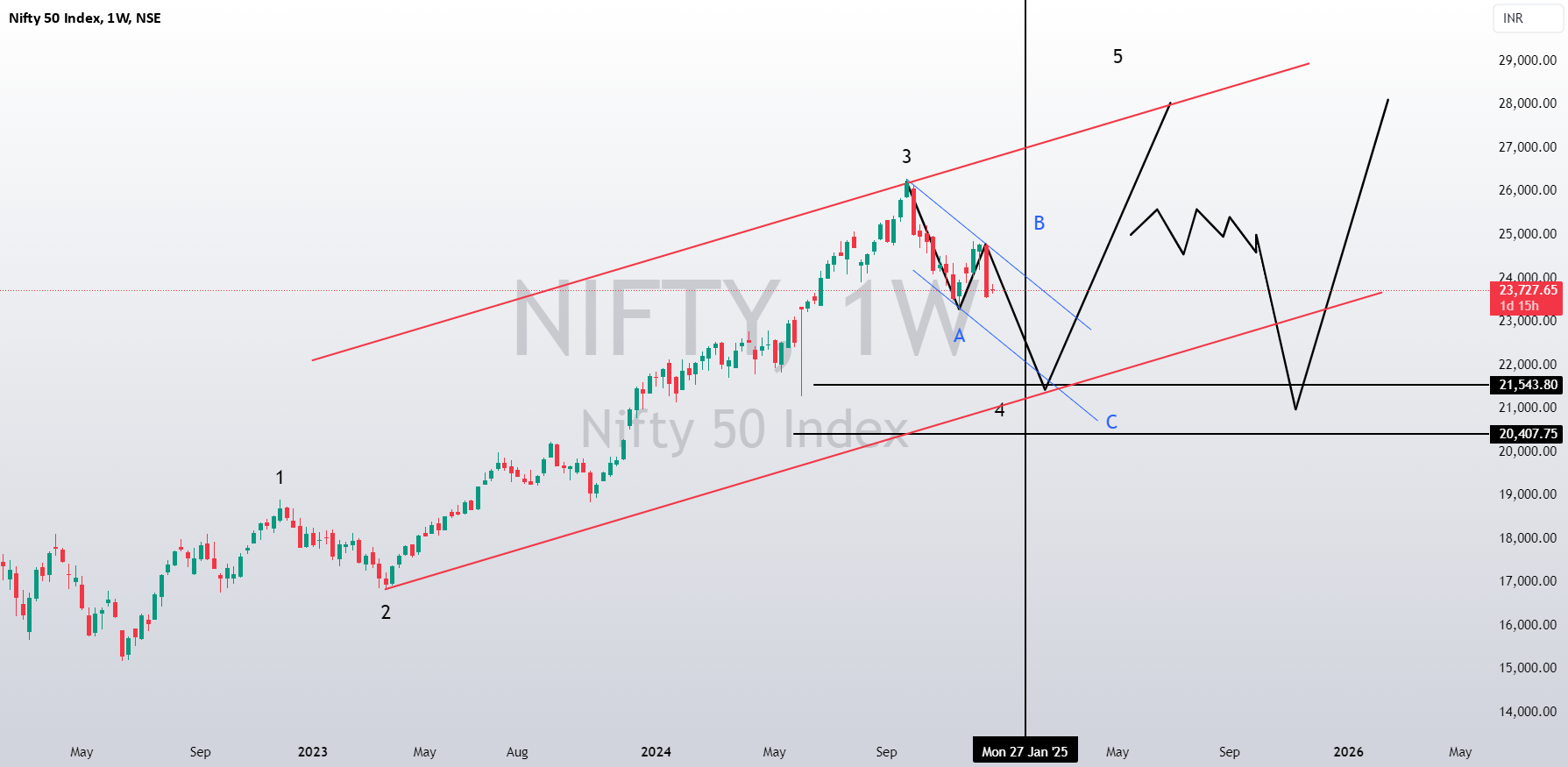

MCL1! A nice liquidity for a 28 W/L ratio

We are out of value but we have rejected from a resistance. A nice confluence of support is easily seen below.

1. VWAP

2. 618 Fibonacci

3. 4H OPEN/CLOSE

Expecting the trade to happen at an interval of few days.

Sadly can’t hold them positions open logn enough,

Anyways, Nice setup to keep in mind! -

XTZUSDT Perpetual Contract

Hey guys, Merry XMas!

Spotted this interesting trade setup on XTZ.

If we can manage to break the top of the channel, I’ll look for an entry after the retest at around $1.45, and making sure we get above that resistance line.

If we move towards the bottom of the channel, then I’ll look for entry points in the purple box that coincide with the bottom of the channel. Maybe the $1.00 price point. -

BTCUSDT SPOT

It is true that I’ve been calling for Bitcoin sideways; not that I been calling for it, that is what Bitcoin has been doing…

Oh wait, Good afternoon my fellow trader, how are you feeling in this wonderful years-end?

I hope you had great fun celebrating the birth of Jesus the Christ and all that, but there is another party just a week away so I hope you can take some of your time to read this. For your entertainment of course 😄😅

Bitcoin has been sideways but this sideways is biased. Price action clearly shows higher highs and higher lows. Will the sideways continue or will Bitcoin break higher?

The truth is that January is only a few days away. 2024 is over.

It can take 10 days, or 20 days… But Bitcoin can grow slowly, moving higher and challenge resistance again.

We see some force at the last resistance point but support is found above 90K. Not at 90K but above it which is a signal of strength.

With this much strength, Bitcoin now being 15 years old. Many people are familiar with it, everybody knows what Bitcoin does every four years; Bitcoin is going up. With all these facts, all this knowing, all this awareness, all this strength, all this growth; can we not speculate that Bitcoin will continue rising? It has been doing so for very long.

The theory of the sideways market was based on the fact that Mars went retrograde earlier this month, around the 7th. It is true… Bitcoin was growing super strong, the entire market and come this date, everything stopped. Then we went on and assumed that the resumption of the bullish wave would happen late in February because that’s when Mars stations direct and the exact same dynamics happened between late 2022 and early 2023 with this Mars retrograde; since it is already happening, why not expect the same?

This is true but this is only one signal, one data point. One signal in isolation can be dangerous. Or it is better to say that multiple signals combined are stronger and give a better picture.

When we add the cyclical bull-market in 2025, the improving market sentiment, global adoption, favorable regulations developing all across the world, etc. We are bullish on Bitcoin! Considering all these things it is easy to be ultra-bullish.

Another reason to be ultra-bullish is because we have been expecting a bull-market in 2025 since always based on all those patterns that we already know. Seeing it happening only reinforces what we predicted and since it is happening we know what’s to come.

The recent bullish wave was just a preview. The next one will be literally twice as strong. So if your favorite pair grew between 300% to 500%, the next one will be between 600% and 1,000%. Amazing. And then there will be another one which will mark the end of the bull-market based on previous cycles.

We are entering a new world, a new reality so this cycle-pattern might be broken and we see something like a super-cycle but we can only know this after the event. For now, we know that Bitcoin is growing in 2025, the Altcoins will grow in 2025, so we are ready to take advantage of this knowing.

What would you do if you knew your favorite Altcoins are ready to grow by 10X?

How best would you take action now to profit from this situation?

How to make the most of this information?

It is happening!

It is already here!

It is not too late… The bull-market is only getting started, get used to it because we want growth, forever growth.

By the way, 150K is not this cycle top. We will see more.

Thank you for reading.

Namaste. -

SOLUSDT Perpetual Contract

Solana is looking good for a mean reversion back to continuation of the bull trend. It has a perfect retracement to the .5 fib level and bounced from there nicely.

I will start new trades at 195 and below for the capture the move back to the 230 level.

Stop loss right below 190. Not a financial advise so DYOR. -

BTC Analysis: Current Market Insights

Bitcoin has settled in the range of $99,000–$95,000, showing signs of weakening bullish momentum. Diminishing trading volumes and macroeconomic pressure suggest the market may be preparing for a downward move.

🔥 FinCaesar’s Key Insights and Strategy:

1. Market Analysis:

Downside Probability: High. A break below $95,000 could lead to a rapid decline to $87,000 or even $75,000.

Upside Potential: A breakout above $102,000 might reignite bullish momentum, but current market conditions favor a correction.

2. Action Plan:

Sell: If price drops below $95,000, secure profits and prepare for a further decline.

Wait to Buy: Avoid buying now. Look for accumulation opportunities near $92,000 or a clear breakout above $102,000 for safe re-entry.

3. Recommendation:

At this moment, selling and waiting for clearer signals or lower levels is the optimal strategy.

“The market rewards patience. Make the right move before it’s too late.” — FinCaesar

#FinCaesar #Bitcoin #CryptoStrategy #BTCForecast #CryptoAnalysis #Blockchain #FinancialFreedom -

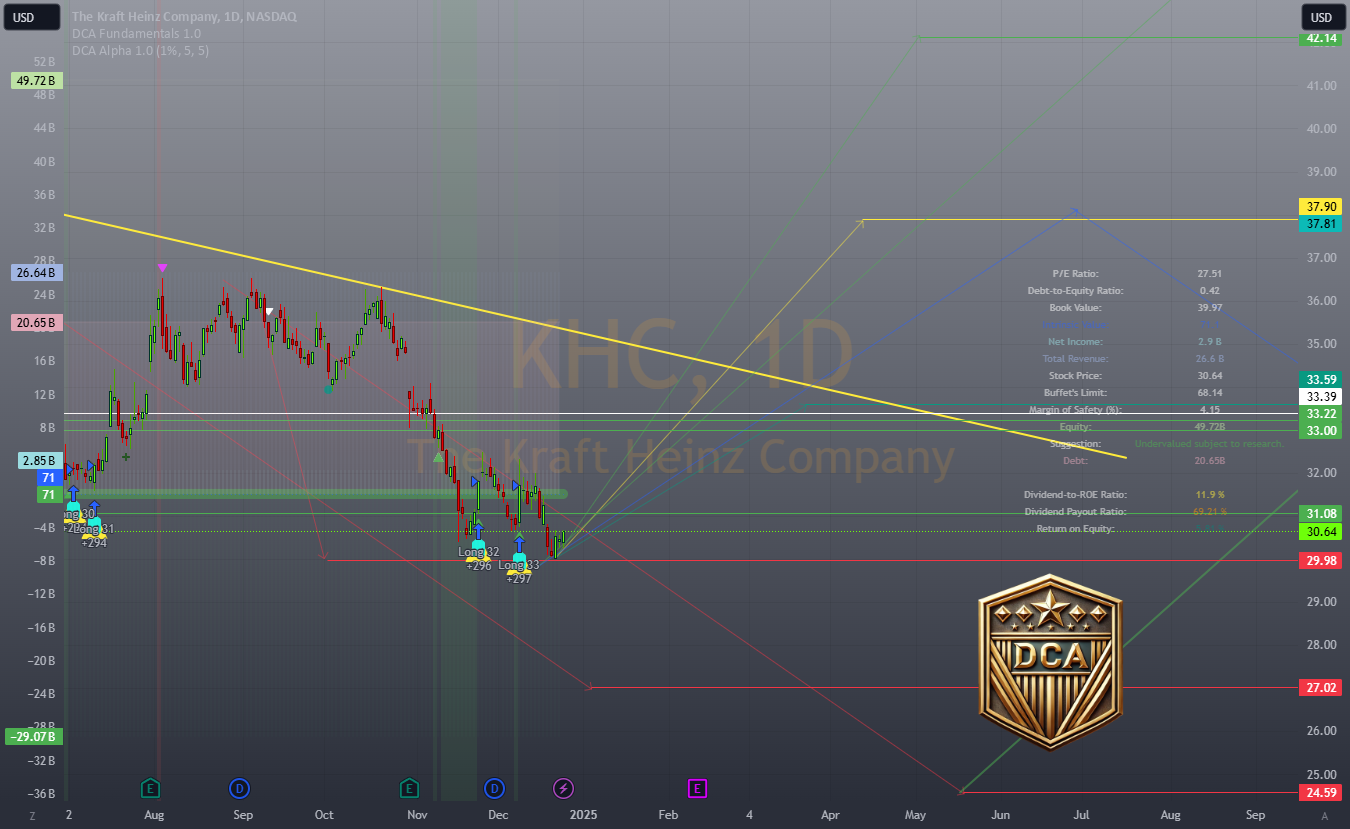

Kraft Heinz $KHC: Dividends, Value, and a Dash of ESG Ambition

Introduction:

Kraft Heinz (KHC) offers a tempting mix of a 4.9% dividend yield, undervaluation metrics, and brand strength. At $30.64, near the bottom of its 52-week range, KHC could be a solid addition to a long-term portfolio. But there’s more—this consumer staples giant is also ramping up its ESG initiatives, showing that even legacy brands can innovate. Let’s unpack the numbers and see if KHC is the value play you’ve been looking for. 📈

Key Points

1. Financial Snapshot 💵

Stock Price: $30.64

52-Week Range: $30.40 – $38.96

Market Cap: $43.71 billion

Dividend Yield: 4.9%

“KHC’s dividend yield is one of the most attractive in the sector, providing consistent income for investors in uncertain markets.”

2. Valuation Metrics 📊

P/E Ratio: 14.8x (below sector averages).

Price-to-Book Ratio: 0.79 (trading below book value).

“With metrics like these, KHC offers a value opportunity for those willing to ride out the turnaround.”

3. ESG Performance 🌱

Kraft Heinz is stepping up in sustainability:

Environmental: Initiatives to reduce carbon emissions and improve water efficiency.

Social: Diversity, equity, and inclusion targets by 2025.

Governance: Transparent reporting and linking executive pay to ESG goals.

“KHC isn’t just about profits—it’s working to align with the growing demand for sustainable and ethical practices.”

4. Buffett’s Endorsement 🛡️

“Berkshire Hathaway still owns a significant stake in Kraft Heinz. While Buffett admits to overpaying, his continued investment signals confidence in the brand strength and dividend reliability.”

5. Investment Strategy 💡

DCA Opportunity: At $30.64, near its 52-week low, KHC is a strong candidate for Dollar Cost Averaging.

Long-Term Potential: With steady dividends and brand strength, KHC is positioned as a reliable income and growth play.

Conclusion:

Kraft Heinz offers value, income, and a growing focus on sustainability. For investors seeking a balance of dividend reliability and long-term growth, KHC could be a worthy addition to your portfolio. 🌟

Disclaimer:

This analysis is for informational purposes only and does not constitute financial advice. Always conduct your own research or consult a financial advisor before making investment decisions.