ADAUSDT Cardano (ADA) Poised for Breakout: Key Levels and Indicators to Watch

Analysis:

Price Action Strategy:

Support and Resistance Levels:

The chart shows key support at approximately 0.85177 (1.618 Fibonacci level) and resistance at 0.90723 (0.5 Fibonacci level).

Trend Analysis:

The price is currently in a consolidation phase after a downtrend, with potential for a breakout above the 0.90723 resistance level.

Volume Analysis:

There is a noticeable increase in volume, indicating potential buying interest.

Smart Money Concepts (SMC):

Break of Structure (BOS):

A BOS is identified at the 0.90723 level, suggesting a potential shift in market structure.

Change of Character (CHOCH):

A CHOCH is observed, indicating a possible reversal from the previous downtrend.

Fair Value Gap (FVG):

An FVG is present around the 0.90723 level, which could act as a magnet for price.

ICT Strategy:

Order Blocks:

Multiple order blocks are identified, with a significant one around the 0.85177 level, indicating strong institutional interest.

Equal Highs:

The chart shows equal highs around the 0.90723 level, suggesting liquidity above this level.

Strong Low:

A strong low is identified, providing a potential support level for a bullish move.

Indicators:

RSI:

The RSI is currently at 65.50, indicating bullish momentum but approaching overbought territory.

MACD:

The MACD shows a bullish crossover, supporting the potential for upward movement.

Buy Signal:

entry: 0.906

tp1: 0.950

tp2: 1.000

sl: 0.875

Follow Alexgoldhunter for more strategic ideas and minds

Cardano

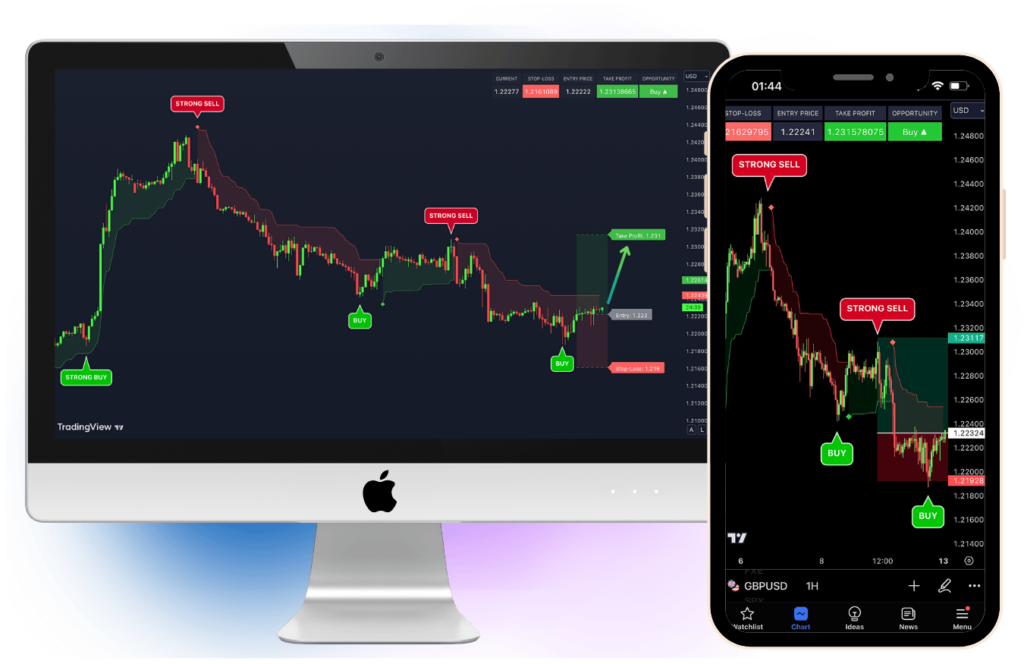

Leveraging AI Indicators for Perfect Trades

In the unpredictable world of cryptocurrency trading, missing the right moment to sell can turn a winning trade into a missed opportunity—or worse, a loss. AI-driven indicators take the guesswork out of this critical decision by analyzing real-time market trends, historical data, and trading patterns to pinpoint the optimal entry & exit points. With these tools, you gain an edge that no manual analysis can provide, ensuring you lock in profits at the perfect time and avoid the costly mistakes of emotional decision-making.

Think about it: how many times have you hesitated to sell, hoping for a bigger return, only to watch the market reverse? AI indicators eliminate this uncertainty, offering actionable insights backed by data. They not only empower you to sell at the top but also help safeguard your profits by alerting you to potential downturns. Whether you’re new to trading or a seasoned veteran, leveraging AI indicators is not just a tool—it’s an essential strategy for success in today’s fast-moving markets.